The high-low method only requires the high and low points of the data and can be worked through with a calculator. It’s also possible to draw incorrect conclusions by assuming that just because two sets of data correlate with each other, one must cause changes in the other. Regression analysis is also best performed using a spreadsheet program or statistics program. Other cost estimation methods may be used alongside or instead of the High-Low Method. She has been assigned the task of budgeting payroll costs piece rates and commission payments for the next quarter. Due to its unreliability, high low method should be carefully used, usually in cases where the data is simple and not too scattered.

- This leads to more informed decisions that enhance operational efficiency and profitability.

- Using the change in cost, the high low method accounting formula allows the variable cost per unit to be calculated.

- It can be argued that activity-cost pairs (i.e. activity level and the corresponding total cost) which are not representative of the set of data should be excluded before using high-low method.

- Hence, once the limit of normal production capacity is reached, the company has to incur another fixed cost irrespective of additional units to be produced.

It is a nominal difference, and choosing either fixed cost for our cost model will suffice. The high-low method is a simple analysis that takes less calculation work. It only requires the high and low points of the data and can be worked through with a simple calculator. The final step qualified retirement plans vs nonqualified plans in the high low method is to calculate the fixed cost component. The high-low method offers a practical solution for addressing mixed costs, simplifying financial reporting.

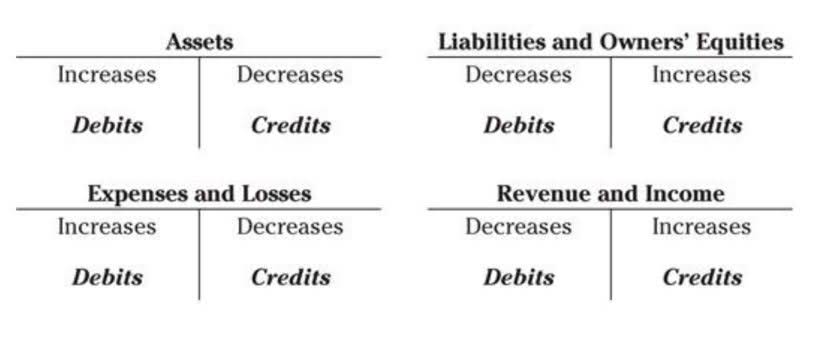

Before costs can be effectively used in analysis, they should be segregated into purely fixed and purely variable costs. Given the variable cost per number of guests, we can now determine our fixed costs. Calculating the outcome for the high-low method requires a few formula steps.

High Low Method Formula

By breaking down mixed costs, companies can ensure compliance with tax regulations and better understand deductible expenses, impacting their effective tax rate and overall financial health. This method also supports accountants in refining financial projections and tax strategies, ensuring alignment with statutory requirements. High Low Method provides an easy way to split fixed and variable components of combined costs using the following formula. By substituting the amounts in the cost equation of the lowest point, we can determine the fixed cost (a). The company plans to produce 7,000 units in March 2019 on the back of buoyant market demand.

The cost of electricity was $18,000 in the month when its highest activity was 120,000 machine hours (MHs). (Be sure to use the MHs that occurred between the meter reading dates appearing on the bill.) The cost of electricity was $16,000 in the month when its lowest activity was 100,000 MHs. This shows that the total monthly cost of electricity changed by $2,000 ($18,000 vs. $16,000) when the number of MHs changed by 20,000 (120,000 vs. 100,000). In other words, the variable cost rate was $0.10 per machine hour ($2,000/20,000 MHs).

- Regression analysis is also best performed using a spreadsheet program or statistics program.

- The high-low method involves several steps to separate fixed and variable costs from mixed costs, providing insights into cost behavior for better financial management and strategic planning.

- It is a nominal difference, and choosing either fixed cost for our cost model will suffice.

- However, this method does not account for inflation and is not very precise because it only takes into account the extreme values and disregards any outliers.

- We can calculate the variable cost and fixed cost components by using the High-Low method.

High Low Variable Cost Formula

The high-low method is used to calculate the variable and fixed costs of a product or entity with mixed costs. It considers the total dollars of the mixed costs at the highest volume of activity and the total dollars of the mixed costs at the lowest volume of activity. The total amount of fixed costs is assumed to be the same at both points of activity.

So, the differential cost of USD 10,000 divided by differential units of 4,000 results in USD 2.5 per unit (10,000/4,000). Similarly, the variable cost of producing 10,000 units has been deducted from the total cost of USD 55,000 at the higher level of activity. Hence, the remaining balance of the numerator is the variable cost of differential 4,000 units. Hence, when we deduct USD 45,000 in USD 55,000, the fixed cost is net and the variable cost to the extent of equality in the level of production is eliminated.

Example of High Low Calculation – High low method formula

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

Formulas

In other words, as fixed cost is the same in both months, the fixed cost has been eliminated by deduction. Hence, the difference in total costs in both months is due to the difference in product level. Simply adding the fixed cost (Step 3) and variable cost (Step 4) gives us the total cost of factory overheads in April. Although easy to understand, high low method may be unreliable because it ignores all the data except for the two extremes. It can be argued that activity-cost pairs (i.e. activity level and the corresponding total cost) which are not representative of the set of data should be excluded before using high-low method.

The high-low method helps organizations break down mixed costs into fixed and variable components, offering a clearer understanding of cost behavior relative to activity levels. This understanding is essential for predicting how costs will change with varying production or service levels, aiding in budgeting and financial planning. For example, a retail company experiencing seasonal sales fluctuations can use this method to forecast costs more accurately and allocate resources efficiently. The high low method is an accounting technique used to estimate the fixed and variable cost of production in businesses. This approach is valuable in cost accounting as it examines and compares the total costs at the highest and lowest levels of activity.

The high-low method can also be done mathematically for accurate computation. Another drawback of the high-low method is the ready availability of net realizable value formula better cost estimation tools. For example, the least-squares regression is a method that takes into consideration all data points and creates an optimized cost estimate. It can be easily and quickly used to yield significantly better estimates than the high-low method. Given the dataset below, develop a cost model and predict the costs that will be incurred in September. Understanding the high low method can be crucial for your business, allowing for efficient cost management and strategic planning for various levels of production.

Data x represents the number of units while y represents the corresponding cost. Take your learning and productivity to the next level with our Premium Templates. The following are the given data for the calculation of the high-low method. For example, the table below depicts the activity for a cake bakery for each of the 12 months of a given year.

The direct costing methods of calculating the variable cost per unit provide accurate figures that consider costs related to the production. Also, the mean or the average variable cost per unit for longer periods can provide more realistic figures than taking extreme activity levels. The high-low method comprises the highest and the lowest level of activity and compares the total costs at each level. The high low method has allowed a total cost to be split into variable and fixed cost components. In the example above the variable cost per unit is 5.00 and fixed costs are 40,000.